SOLUTIONS

Digital TA

Accelerate trade processing, cut costs, and ensure transparent ledgers with blockchain technology.

Selected by

Tackling Transfer Agency Challenges

Legacy Systems Holding

Back Innovation

Outdated platforms hinder digital transformation and increase inefficiencies.

Manual Processes Lead to Errors

Non-automated workflows cause delays, inaccuracies, and high operational costs.

Limited Transparency

Traditional systems lack real-time visibility and unified data, slowing fund distribution.

Revolutionizing asset management and service with a cutting-edge digital Transfer Agent platform

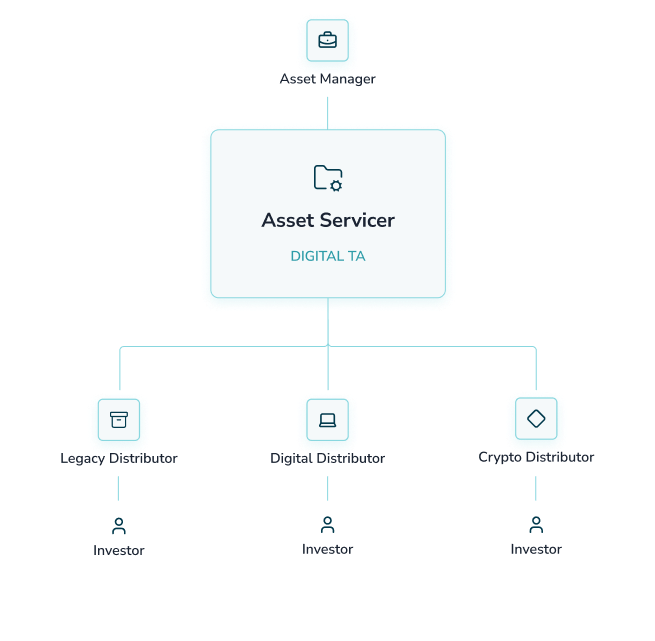

Tailored Solution for Asset Servicers

Digital TA redefines the transfer agency function for asset servicers, modernizing operations and improving service delivery to asset managers. By automating workflows and integrating seamlessly with industry systems, it enhances efficiency and reduces operational costs while while supporting multiple onshore and offhore fund domiciles in Europe, Middle East and Asia, and various asset classes.

Key benefits

- A scalable, flexible infrastructure that integrates with legacy systems while offering modern digital services

- Supporting multiple asset managers on the same platform.

- Automated core TA functions, reducing the time and effort spent on manual processes

- Real-time capabilities that enhance transaction efficiency and data accuracy

- Seamless integration into the client's operating model, supporting various distribution channels and country-specific requirements

- Multi-asset support, covering UCITS, ETFs, money market funds, private market and alternative funds

- Embedded fund tokenisation enabling penetration of new distribution channels (digital banks, crypto exchanges, public blockchain)

By leveraging Digital TA, asset services can confidently meet the needs of modern asset managers, offering efficient, forward-looking solutions while driving down costs.

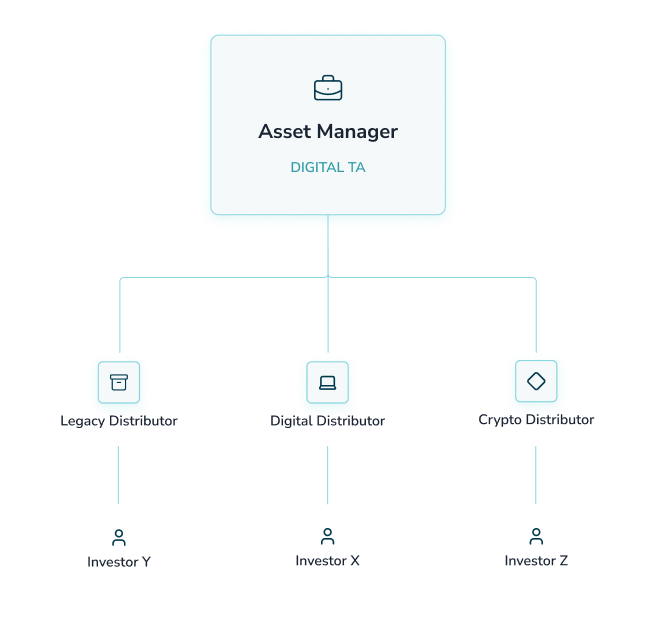

Tailored Solution for Asset Managers

Digital TA provides asset managers with a next-generation transfer agency solution designed to enhance operational efficiency and investor engagement. By leveraging a cloud-native architecture, it eliminates the limitations of legacy systems and introduces real-time trade processing for individual transactions. It supports multiple onshore and offhore fund domiciles in Europe, Middle East and Asia, and various asset classes.

Key benefits

- A real-time investor register that offers enhanced visibility and transparency

- Improved workflows that streamline investor communication and reduce manual intervention

- Flexible integration with distribution networks, adapting to country, distributor and platforms requirements

- Multi-asset support, including UCITS, ETFs, money market funds, private market and alternative funds.

- Embedded fund tokenisation enabling penetration of new distribution channels (digital banks, crypto exchanges, public blockchain)

With Digital TA, asset managers unlock efficiency, reduce process complexity, and gain the tools to distribute funds faster and with greater confidence.

Key features

Universal Shared Register & Tokenization

Utilizes blockchain to maintain a transparent and auditable ledger.

Multi-Asset & Multi-Domicile Support

Covers UCITS, ETFs, money market, private market funds, and hedge funds across expanding global markets.

Automation

Automates repetitive tasks, minimizing manual intervention and reducing processing time.

Enhanced Security & Interoperability

Ensures compliance with advanced security protocols while seamlessly connecting with various data sources and third-party services.

Functionalities that help solve problems

Order Processing

& Cash Settlement

Streamlines order receipt, commission computation, payments, settlements, cash reconciliation, and FX/hedging.

Reporting

Delivers real-time data for analytics or integration via API, with pre-formatted reports like Confirmation Notes and Tax Statements.

Investor & Register Maintenance

Ensures accurate management of fund,

investor, corporate actions, and static data with customizable rules.

Scalable Architecture

Offers security, flexibility, and adaptability for diverse business needs.

Seamless Integration

Connects to client ecosystem (fund accounting, custody, PMS, KYC, and cash settlement) and to distributors via API, SWIFT, KAFKA, FIX, and file transfer.

See how it works

RELATED SOLUTIONS

Enables asset managers to reach investors through a customizable, omnichannel solution.

Centralizes commercialization activities, ensuring compliancy, efficient account management and order forwarding to your TA.

Native tokenization of fund shares with secure, compliant fund tokenization platform on blockchain.

Digitize Your Fund Operations Today